Integrated Report | BASF

Integrated corporate report on economic, environmental and social performance

BASF Report 2021 Integrated corporate report on economic, environmental and social performance

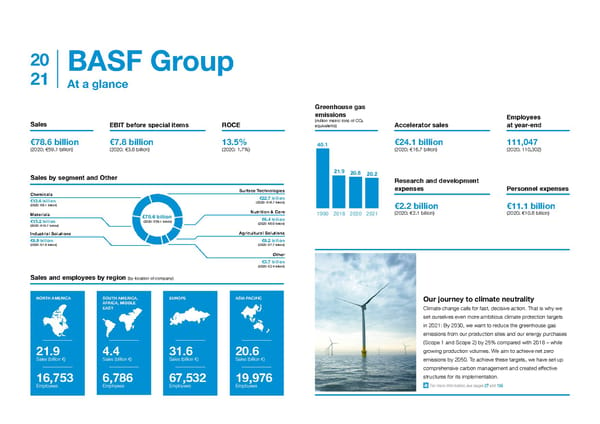

20 BASF Group 21 At a glance Greenhouse gas emissions Employees (million metric tons of CO Sales EBIT before special items ROCE equivalents) 2 Accelerator sales at year-end €78.6 billion €7.8 billion 13.5% 40.1 €24.1 billion 111,047 (2020: €59.1 billion) (2020: €3.6 billion) (2020: 1.7%) (2020: €16.7 billion) (2020: 110,302) 21.9 20.8 20.2 Sales by segment and Other Research and development Surface Technologies expenses Personnel expenses Chemicals €22.7 billion €13.6 billion (2020: €16.7 billion) (2020: €8.1 billion) €2.2 billion €11.1 billion Materials Nutrition & Care 1990 2018 2020 2021 (2020: €2.1 billion) (2020: €10.6 billion) €78.6 billion €6.4 billion €15.2 billion (2020: €59.1 billion) (2020: €6.0 billion) (2020: €10.7 billion) Industrial Solutions Agricultural Solutions €8.9 billion €8.2 billion (2020: €7.6 billion) (2020: €7.7 billion) Other €3.7 billion (2020: €2.4 billion) Sales and employees by region (by location of company) NORTH AMERICA SOUTH AMERICA, EUROPE ASIA PACIFIC Our journey to climate neutrality AFRICA, MIDDLE EAST Climate change calls for fast, decisive action. That is why we set ourselves even more ambitious climate protection targets in 2021: By 2030, we want to reduce the greenhouse gas emissions from our production sites and our energy purchases (Scope 1 and Scope 2) by 25% compared with 2018 – while 21.9 4.4 31.6 20.6 growing production volumes. We aim to achieve net zero Sales (billion €) Sales (billion €) Sales (billion €) Sales (billion €) emissions by 2050. To achieve these targets, we have set up comprehensive carbon management and created effective 16,753 6,786 67,532 19,976 structures for its implementation. Employees Employees Employees Employees For more information, see pages 27 and 126

BASF Report 2021 Welcome to BASF Our integrated corporate report combines financial and sustainability reporting. It shows how we are developing as a company and how we create value for our shareholders with what we do. On the cover and this page: BASF is one of the leading manufacturers of battery materials for electric vehicles and continues to invest in this important growth market. For example, we are building a new production plant for cathode materials in Schwarzheide, Germany, which will start operation in 2022. Both photos show Ina Homann. As an assistant process manager, her responsibilities include monitoring the progress of construction at her future workplace. After working in analytics and process optimization and obtaining further technical qualifications, she is now part of BASF’s team to help shape the future of climate-smart mobility. For more information on battery materials and electromobility, see weloveevs.basf.com

BASF Report 2021 4 Contents Contents To Our Shareholders Management’s Report Corporate Governance Consolidated Financial Statements Overviews About This Report 5 1 | To Our Shareholders 7 3 | Corporate Governance 161 5 | Overviews 286 Letter from the Chairman of the Board of Executive Directors 8 Corporate Governance Report 162 Ten-Year Summary 287 The Board of Executive Directors of BASF SE Glossary and Trademarks 289 11 Compliance 171 BASF on the Capital Market 12 Management and Supervisory Boards 174 Report of the Supervisory Board 177 Declaration of Conformity Pursuant to Section 161 AktG 184 2 | Management’s Report 16 Declaration of Corporate Governance 185 Overview 17 20 The BASF Group 4 | Consolidated Financial Statements 186 Our Strategy 26 Statement by the Board of Executive Directors 187 The BASF Group’s Business Year 52 Independent Auditor’s Report 188 Sustainability Along the Value Chain 96 Statement of Income 194 Forecast 145 195 Statement of Income and Expense Recognized in Equity Balance Sheet 196 Statement of Cash Flows 198 199 Statement of Changes in Equity Notes 200

BASF Report 2021 About This Report 5 About This Report GRI 102, 305 Integrated reporting and online services At a glance progress report on BASF’s implementation of the 10 principles of the This integrated report documents BASF’s economic, environmental U.N. Global Compact. and social performance in 2021. We show how sustainability con- ▪ Integrated BASF Report serves as U.N. Global Compact progress tributes to BASF’s long-term success as an integral part of our cor- report The GRI and Global Compact Index can be found in the online porate purpose and our strategy, and how we as a company create ▪ Nonfinancial reporting in accordance with HGB and additional report. It provides an overview of all relevant information to fulfill the value for our stakeholders. sustainability reporting in accordance with GRI GRI indicators and shows how we contribute to the United Nations’ ▪ Financial reporting in accordance with IFRS, HGB and GAS Sustainable Development Goals (SDGs) and the principles of the Symbols U.N. Global Compact. The results of the limited assurance of this ▪ Editorial deadline: February 21, 2022 gesell - information conducted by KPMG AG Wirtschaftsprüfungs You can find more information in this report. ▪ External audit by KPMG AG Wirtschaftsprüfungsgesellschaft schaft can also be found there. We also publish online additional information on sustainability in accordance with the industry-specific You can find more information online. The content of these requirements of the SASB. links are voluntary disclosures that were not audited by the auditor. Content and structure The information on the financial position and performance of the BASF Group comply with the requirements of International Financial The content of this section is not part of the statutory audit but The BASF Report, which is published each year in English and Reporting Standards (IFRS), and, where applicable, the German has undergone a separate limited assurance by our auditor. German, combines the major financial and sustainability-related Commercial Code (HGB), German Accounting Standards (GAS) and information necessary to comprehensively evaluate our performance. the guidelines on alternative performance measures from the Euro- The content of this section is voluntary, unaudited information, We select the report’s topics based on the following principles: pean Securities and Markets Authority (ESMA). Internal control which was critically read by the auditor. materiality, sustainability context, completeness, balance and stake- mechanisms ensure the reliability of the information presented in this holder inclusion. In addition to this report, we publish further informa- report. BASF’s Board of Executive Directors confirmed the effective- tion online. The relevant links can be found at the end of each chapter. ness of the internal control measures and compliance with the regu- lations for financial reporting. Our sustainability reporting has been based on Global Reporting Initiative (GRI) guidelines and standards since 2003. We have applied Material topics along the value chain form the focal points of report- the “Comprehensive” option since 2017. ing and define the limits of this report. We take three dimensions into account in identifying and evaluating material topics: the impact on We have been active in the International Integrated Reporting Council BASF, the impact of BASF and relevance for our stakeholders. (IIRC) since 2014 and have supported the work of the Value Report- For more information on our sustainability reporting, see from page 45 and 96 onward ing Foundation, formed by the merger of the IIRC and the Sustain- Our value creation based on the IIRC framework can be found on page 24 and in the online report ability Accounting Standards Board (SASB), since 2021. This involve- For more information on our control and risk management system, see page 151 onward ment gives us the opportunity to discuss our experiences of The 2021 BASF Online Report can be found at basf.com/report integrated reporting with stakeholders and at the same time, receive The GRI and Global Compact Index can be found at basf.com/en/gri-gc inspiration for enhancing our reporting. BASF’s report addresses ele- The SASB index can be found at basf.com/sasb ments of the IIRC framework by illustrating how we create value, for example. The information contained in this report also serves as a

BASF Report 2021 About This Report 6 Data reported in full. Unless otherwise indicated, data on social responsi- steering target in 2022. The links and additional content provided on bility and transportation safety refers to BASF SE and its consolidated linked internet sites are not part of the audited information. All information and bases for calculation in this report are founded subsidiaries. on national and international standards for financial and sustain- KPMG also conducted a limited assurance of the nonfinancial group ability reporting. The data and information for the reporting period The divested pigments business is included in the disclosures and statement (NFS). were sourced from the expert units responsible using representative indicators on employees, the environment, and health and safety on The Independent Auditor’s Report can be found on page 188 onward methods. Due to rounding, individual figures may not add up exactly a pro rata basis until June 30, 2021. Sales from the divested pig- An assurance statement on the sustainability information in the BASF Report 2021 can be found at to the totals shown and percentages may not correspond exactly to ments business are no longer integrated in the portfolio to be evalu- basf.com/sustainability_information the figures shown. ated under the Sustainable Solution Steering method for 2021. An assurance statement of the NFS can be found at basf.com/nfs-audit-2021 BASF Shanshan Battery Materials Co., Ltd., which was formed on The reporting period is the 2021 business year. Relevant information August 31, 2021, is included in the sustainability disclosures and Forward-looking statements and forecasts is included up to the editorial deadline of February 21, 2022. indicators on a pro rata basis. The company’s sales to third parties are already included in the sum of relevant sales according to This report contains forward-looking statements. These statements BASF Group’s scope of consolidation for its financial reporting com- the Sustainable Solution Steering method. They are listed as “not are based on current estimates and projections of the Board of prises BASF SE, with its headquarters in Ludwigshafen, Germany, assessed.” We will start classification in 2022. Executive Directors and currently available information. Forward- and all of its fully consolidated subsidiaries and proportionally con- For more information on companies accounted for in the Consolidated Financial Statements, see the looking statements are not guarantees of the future developments solidated joint operations. Shares in joint ventures and associated Notes from page 205 onward and results outlined therein. These are dependent on a number of companies are accounted for, if material, using the equity method in The list of shares held can be found at basf.com/en/corporategovernance factors; they involve various risks and uncertainties; and they are the BASF Group Consolidated Financial Statements and are thus based on assumptions that may not prove to be accurate. Such risk not included in the scope of consolidation. factors include those discussed in Opportunities and Risks on External audit pages 151 to 160. We do not assume any obligation to update the The section “Employees” refers to employees active in a company forward- looking statements contained in this report above and within the BASF Group scope of consolidation as of December 31, Our reporting is audited by a third party. KPMG AG Wirtschafts- beyond the legal requirements. 2021. prüfungsgesellschaft has audited the BASF Group Consolidated Financial Statements and the Management’s Report and has Our data collection methods for environmental protection and safety approved themn free of qualification. are based on the recommendations of the International Council of Chemical Associations (ICCA) and the European Chemical Industry The limited assurance of the sustainability information contained in Council (CEFIC). In the section “We Produce Safely and Efficiently,” the Management’s Report was conducted in accordance with we report all data of the worldwide production sites of BASF SE, its ISAE 3000 (Assurance Engagements other than Audits or Reviews fully consolidated subsidiaries, and proportionally consolidated joint of Historical Financial Information) and ISAE 3410 (Assurance operations. BASF SE subsidiaries that are fully consolidated in the Engagements on Greenhouse Gas Statements), the relevant inter- Group financial statements in which BASF holds an interest of less national assurance standards for sustainability reporting. KPMG than 100% are included in full in environmental reporting. The emis- conducted a reasonable assurance of all disclosures on the most sions of proportionally consolidated joint operations are disclosed important nonfinancial key performance indicators, accelerator pro rata according to our interest. Work-related accidents at all sites sales and CO emissions. The forecast for the key performance 2 of BASF SE and its subsidiaries as well as joint operations and joint indicator CO emissions is also part of the Management’s Report 2 ventures in which we have sufficient authority in terms of safety and is covered by the annual audit. No forecast has been made for management are compiled worldwide regardless of our interest and the previous Accelerator target as we plan to update our portfolio

BASF Report 2021 7 Contents To Our To Our Shareholders Management’s Report Corporate Governance Consolidated Financial Statements Shareholders Overviews 1 Letter from the Chairman of the Board of Executive 8 Directors 11 The Board of Executive Directors of BASF SE 12 BASF on the Capital Market

Letter from the Chairman of the Board of Executive Directors BASF Report 2021 To Our Shareholders – Letter from the Chairman of the Board of Executive Directors 8 At BASF, we have an ambitious dividend policy. Our free cash flow of €3.7 billion reflects our financial strength. Therefore, we will propose to the Annual Share- holders’ Meeting a dividend of €3.40 per share, representing an increase of 10 euro cents compared with the previous year. We want to be an attractive investment and reliably create value for you, our shareholders. The development of our share price in 2021 remained well below our expectations, despite our very good » operating performance and targeted strategic devel- At BASF, we have an op ment. Given that we believe that BASF is signifi- cantly under valued on the capital market, we decided ambitious dividend on January 4, 2022, to buy back own shares in the policy. amount of up to €3 billion. What makes us so confident about the value of BASF? What are our priorities for the transformation to climate neutrality and the further development of our company? As the largest chemical company in the world, we are leaders in our industry. We are ambitious. This applies especially to the transformation to climate neutrality. We want to show that this transformation and competitiveness are not mutually exclusive. Our global responsibility for sustainable development is anchored in our corporate purpose: We create chemistry for a sustainable future. 2021 was a very successful business year for BASF. Despite the ongoing coronavirus pandemic, widespread supply bottlenecks, and increasingly higher Effective climate protection and scarce resources are the central challenges energy and raw materials prices, we achieved record levels of sales and earnings. of our time. We want to reduce our CO2 emissions worldwide by 25% by 2030 We achieved an EBIT before special items of €7.8 billion. Our sales volumes were compared with 2018. Our 2050 target is net zero emissions. These are very five percentage points above the 6% growth in the global chemical industry and ambitious goals. It is the biggest transformation in the history of the chemical we raised prices by 25%. This enabled us to once again earn a premium on our industry and for BASF, considering that our production is energy intensive and cost of capital in 2021. Our economic development confirms that we are on the that we want to continue to grow at the same time. The energy transformation will right path with our strategic direction, our adapted organizational structure and make great demands on us. But we are confident that we will succeed! our ongoing cost discipline. We can only reach climate neutrality if we completely transform our production by replacing energy sources based on fossil fuels with electricity from renewable resources. That will require entirely new processes and technologies and the

BASF Report 2021 To Our Shareholders – Letter from the Chairman of the Board of Executive Directors 9 courage to think in new directions. It will involve converting the big steam CO -free chemical production is the future. And BASF wants to be among the 2 crackers from heating based on fossil fuels to electrical heating. In these plants, first there. It all starts with transparency, which is why we provide our custom ers at the beginning of the value chains, steam is used to split naphtha into basic with Product Carbon Footprints (PCF) – the carbon footprint associated with chemicals at about 850 degrees Celsius. Other production per kilogram of sales product – for each of our 45,000 sales products. examples include the CO -free production of hydro- Furthermore, we help our customers develop strategies to reduce their carbon » 2 With our innovation power, gen by water electrolysis and methane pyrolysis, and footprint, to use resources more efficiently, and to manufacture products in a using waste heat recovered with heat pumps instead more environmentally friendly way. We expect that demand for such emission-free crea tivity and entre pre of con ven tional steam generation in gas-fired power or emission-reduced products will exceed supply in the medium term, and that neurial courage, we look plants. We will invest roughly €4 billion to reach our their market value will more than compensate for the higher production costs. It 2030 emission reduction targets. therefore also makes good economic sense to take a leading role here. That is to the future with why we want to be among the first to provide as many products as possible from optimism. We are also redefining raw material cycles through our portfolio with a reduced carbon footprint in large volumes by the end of the recycling. Good examples of this are the chemical decade. This differentiates us, increases our competitiveness and enables growth recycling process in which a new raw material, above market. pyrolysis oil, is obtained from plastic waste; the recycling of mattresses, which are broken down into polyurethane precursors; and the use of bio-based raw Profitable growth lays the foundation for a success- materials. There is a great feeling of excitement in the BASF team! With our inno- ful transformation. This is why we continue to focus » vation power, creativity and entrepr eneurial courage, we look to the future with our portfolio and business activities on organic CO free chemical optimism. growth. And the reverse is also true: The transforma - 2 tion is the foundation for a wide range of growth production is the future. Electricity from renewable sources in great quantities and at favorable prices opportunities! Neither future prosperity nor climate And BASF wants to be would enable us to achieve a climate-neutral future. This is made possible by the neutrality is possible without a competitive chemical electrification of entire value chains. To achieve this, we need to massively expand industry and innovative chemical products. Extensive among the first there . renewable energies worldwide. Currently, this is not happening fast enough. That regulations driven by policymakers and society do is why we are leading the way and securing access to green power. We already present a tremendous challenge to industry in general announced several projects in 2021 as part of the implementation of our and particularly to the chemical industry. At the same time, however, they lead to Make & Buy strategy: We have secured a half share in a 1.5 gigawatt offshore new business opportunities. The dynamic development from the combustion wind park from Vattenfall in the North Sea off the coast of the Netherlands. It engine to electromobility is a good example of this. As a leading chemical supplier should be connected to the grid in 2023. It will be the world’s biggest offshore to the automotive industry and producer of innovative cathode active materials wind farm – and all this without any public subsidies. We are taking a different for electric vehicle batteries, we are able to profit from this development. Growth approach with Ørsted and Engie: We have concluded attractive electricity supply and climate protection go hand in hand: Our materials not only support the contracts with both energy companies for a term of 25 years. In other regions dynamic growth of this market, but their low carbon footprint also paves the way as well, for example, in the United States and China, we are securing access to for climate-neutral mobility. green power. In this way, we are planning proactively and laying the foundation to ensure a long-term supply of electricity from renewable resources.

BASF Report 2021 To Our Shareholders – Letter from the Chairman of the Board of Executive Directors 10 China is already the largest chemical market in the world and has high growth potential in the long term. With the construction of our new Verbund site in Zhanjiang in the southern Chinese province of Guangdong, we want to further accelerate our profitable growth in the region. We are setting new standards in energy transformation there as well. By taking advantage of a new regulatory framework and signing a supply agreement for electricity from renewable sources with China » Resources Power in June 2021, we will be able Climate neutrality and to operate the first plants at the new Verbund site in Zhanjiang completely with green power. sustainable resource use Sustainable solutions and innovative products are not possible without a across our entire portfolio enable us to remain on our growth path and systematically drive the competitive chemical transformation to greater sustainability. industry. We act swiftly and systematically in the imple- mentation of our long-term strategy for profitable growth. I am convinced that climate neutrality and sustainable resource use are not possible without a competitive chemical industry. Our company is very well positioned. We make our contribution to society and at the same time, secure our long-term competitiveness. I am pleased that you support us on our path to a sustainable future. Many thanks for your trust. Yours, Martin Brudermüller

BASF Report 2021 To Our Shareholders – The Board of Executive Directors of BASF SE 11 The Board of Executive Directors of BASF SE From left: Dr. Markus Kamieth, Saori Dubourg, Dr. Hans-Ulrich Engel (Vice Chairman of the Board of Executive Directors), Dr. Martin Brudermüller (Chairman of the Board of Executive Directors), Dr. Melanie Maas-Brunner, Michael Heinz Group photo taken in compliance with the applicable coronavirus prevention measures

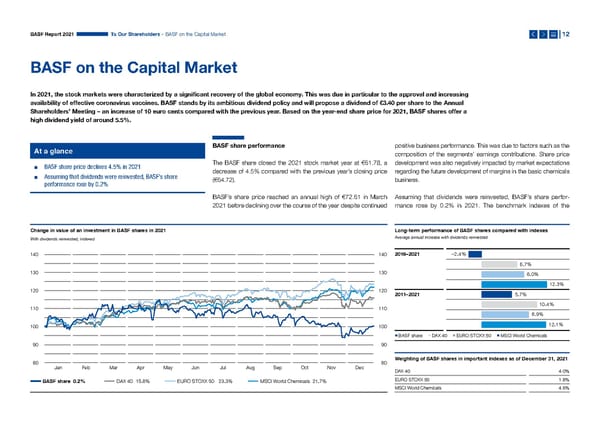

BASF Report 2021 To Our Shareholders – BASF on the Capital Market 12 BASF on the Capital Market In 2021, the stock markets were characterized by a significant recovery of the global economy. This was due in particular to the approval and increasing availability of effective coronavirus vaccines. BASF stands by its ambitious dividend policy and will propose a dividend of €3.40 per share to the Annual Shareholders’ Meeting – an increase of 10 euro cents compared with the previous year. Based on the year-end share price for 2021, BASF shares offer a high dividend yield of around 5.5%. At a glance BASF share performance positive business performance. This was due to factors such as the composition of the segments’ earnings contributions. Share price ▪ BASF share price declines 4.5% in 2021 The BASF share closed the 2021 stock market year at €61.78, a development was also negatively impacted by market expectations ▪ Assuming that dividends were reinvested, BASF’s share decrease of 4.5% compared with the previous year’s closing price regarding the future development of margins in the basic chemicals performance rose by 0.2% (€64.72). business. BASF’s share price reached an annual high of €72.61 in March Assuming that dividends were reinvested, BASF’s share perfor- 2021 before declining over the course of the year despite continued mance rose by 0.2% in 2021. The benchmark indexes of the Change in value of an investment in BASF shares in 2021 Long-term performance of BASF shares compared with indexes With dividends reinvested; indexed Average annual increase with dividends reinvested 140 140 2016–2021 –2.4% 6.7% 130 130 8.0% 12.3% 120 120 2011–2021 5.7% 110 110 10.4% 8.9% 100 100 12.1% ▪ ▪ ▪ ▪ BASF share DAX 40 EURO STOXX 50 MSCI World Chemicals 90 90 80 80 Weighting of BASF shares in important indexes as of December 31, 2021 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec DAX 40 4.0% BASF share 0.2% DAX 40 15.8% EURO STOXX 50 23.3% MSCI World Chemicals 21.7% EURO STOXX 50 1.8% MSCI World Chemicals 4.6%

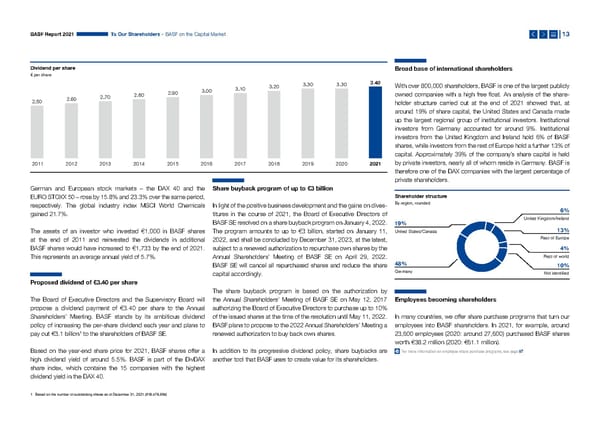

BASF Report 2021 To Our Shareholders – BASF on the Capital Market 13 Dividend per share Broad base of international shareholders € per share 3.20 3.30 3.30 3.40 With over 800,000 shareholders, BASF is one of the largest publicly 2.90 3.00 3.10 2.70 2.80 owned companies with a high free float. An analysis of the share- 2.50 2.60 holder structure carried out at the end of 2021 showed that, at around 19% of share capital, the United States and Canada made up the largest regional group of institutional investors. Institutional investors from Germany accounted for around 9%. Institutional investors from the United Kingdom and Ireland hold 6% of BASF shares, while investors from the rest of Europe hold a further 13% of capital. Approximately 39% of the company’s share capital is held 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 by private investors, nearly all of whom reside in Germany. BASF is therefore one of the DAX companies with the largest percentage of private shareholders. German and European stock markets – the DAX 40 and the Share buyback program of up to €3 billion EURO STOXX 50 – rose by 15.8% and 23.3% over the same period, Shareholder structure respectively. The global industry index MSCI World Chemicals In light of the positive business development and the gains on dives- By region, rounded gained 21.7%. titures in the course of 2021, the Board of Executive Directors of 6% BASF SE resolved on a share buyback program on January 4, 2022. United Kingdom/Ireland 19% The assets of an investor who invested €1,000 in BASF shares The program amounts to up to €3 billion, started on January 11, United States/Canada 13% at the end of 2011 and reinvested the dividends in additional 2022, and shall be concluded by December 31, 2023, at the latest, Rest of Europe BASF shares would have increased to €1,733 by the end of 2021. subject to a renewed authorization to repurchase own shares by the 4% This represents an average annual yield of 5.7%. Annual Shareholders’ Meeting of BASF SE on April 29, 2022. Rest of world BASF SE will cancel all repurchased shares and reduce the share 48% 10% capital accordingly. Germany Not identified Proposed dividend of €3.40 per share The share buyback program is based on the authorization by The Board of Executive Directors and the Supervisory Board will the Annual Shareholders’ Meeting of BASF SE on May 12, 2017 Employees becoming shareholders propose a dividend payment of €3.40 per share to the Annual authorizing the Board of Executive Directors to purchase up to 10% Shareholders’ Meeting. BASF stands by its ambitious dividend of the issued shares at the time of the resolution until May 11, 2022. In many countries, we offer share purchase programs that turn our policy of increasing the per-share dividend each year and plans to BASF plans to propose to the 2022 Annual Shareholders’ Meeting a employees into BASF shareholders. In 2021, for example, around pay out €3.1 billion1 to the shareholders of BASF SE. renewed authorization to buy back own shares. 23,600 employees (2020: around 27,600) purchased BASF shares worth €38.2 million (2020: €61.1 million). Based on the year-end share price for 2021, BASF shares offer a In addition to its progressive dividend policy, share buybacks are For more information on employee share purchase programs, see page 97 high dividend yield of around 5.5%. BASF is part of the DivDAX another tool that BASF uses to create value for its shareholders. share index, which contains the 15 companies with the highest dividend yield in the DAX 40. 1 Based on the number of outstanding shares as of December 31, 2021 (918,478,694)

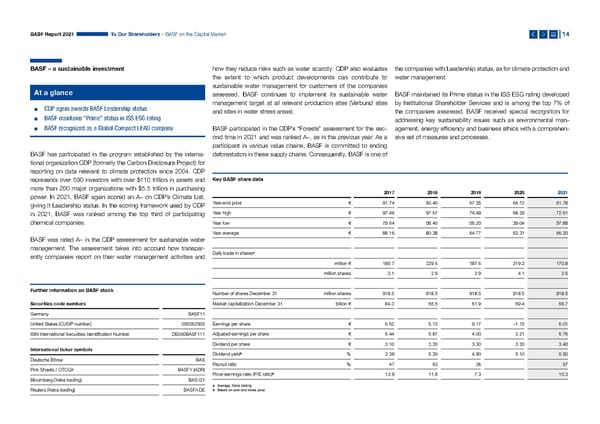

BASF Report 2021 To Our Shareholders – BASF on the Capital Market 14 BASF – a sustainable investment how they reduce risks such as water scarcity. CDP also evaluates the companies with Leadership status, as for climate protection and the extent to which product developments can contribute to water management. sustainable water management for customers of the companies At a glance assessed. BASF continues to implement its sustainable water BASF maintained its Prime status in the ISS ESG rating developed ▪ CDP again awards BASF Leadership status management target at all relevant production sites (Verbund sites by Institutional Shareholder Services and is among the top 7% of and sites in water stress areas). the companies assessed. BASF received special recognition for ▪ BASF maintains “Prime” status in ISS ESG rating address ing key sustainability issues such as environmental man- ▪ BASF recognized as a Global Compact LEAD company BASF participated in the CDP’s “Forests” assessment for the sec- agement, energy efficiency and business ethics with a comprehen- ond time in 2021 and was ranked A–, as in the previous year. As a sive set of measures and processes. participant in various value chains, BASF is committed to ending BASF has participated in the program established by the interna- deforestation in these supply chains. Consequently, BASF is one of tional organization CDP (formerly the Carbon Disclosure Project) for reporting on data relevant to climate protection since 2004. CDP represents over 590 investors with over $110 trillion in assets and Key BASF share data more than 200 major organizations with $5.5 trillion in purchasing 2017 2018 2019 2020 2021 power. In 2021, BASF again scored an A– on CDP’s Climate List, giving it Leadership status. In the scoring framework used by CDP Year-end price € 91.74 60.40 67.35 64.72 61.78 in 2021, BASF was ranked among the top third of participating Year high € 97.46 97.67 74.49 68.29 72.61 chemical companies. Year low € 79.64 58.40 56.20 39.04 57.88 Year average € 88.16 80.38 64.77 53.31 66.20 BASF was rated A– in the CDP assessment for sustainable water management. The assessment takes into account how transpar - ently companies report on their water management activities and Daily trade in sharesa million € 185.7 229.6 187.6 219.2 170.8 million shares 2.1 2.9 2.9 4.1 2.6 Further information on BASF stock Number of shares December 31 million shares 918.5 918.5 918.5 918.5 918.5 Securities code numbers Market capitalization December 31 billion € 84.3 55.5 61.9 59.4 56.7 Germany BASF11 United States (CUSIP number) 055262505 Earnings per share € 6.62 5.12 9.17 –1.15 6.01 ISIN International Securities Identification Number DE000BASF111 Adjusted earnings per share € 6.44 5.87 4.00 3.21 6.76 Dividend per share € 3.10 3.20 3.30 3.30 3.40 International ticker symbols Dividend yieldb % 3.38 5.30 4.90 5.10 5.50 Deutsche Börse BAS Payout ratio % 47 63 36 . 57 Pink Sheets / OTCQX BASFY (ADR) Price-earnings ratio (P/E ratio)b 13.9 11.8 7.3 . 10.3 Bloomberg (Xetra trading) BAS GY a Average, Xetra trading Reuters (Xetra trading) BASFn.DE b Based on year-end share price

BASF Report 2021 To Our Shareholders – BASF on the Capital Market 15 1 In Sustainalytics’ ESG Risk Ratings, BASF is ranked among the top Close dialog with the capital market At a virtual Investor Update in September 2021, Dr. Martin 10% of companies in diversified chemicals. It was commended for Brudermüller and Dr. Markus Kamieth informed investors about the fact that its sustainability targets are reflected in the compensa- the BASF Group’s two major growth projects: our future Verbund tion for the Board of Executive Directors, underlining strong overall At a glance site in Zhanjiang, China, and our battery materials activities. management of environmental, social and governance matters. ▪ Virtual formats facilitate dialog during coronavirus pandemic Finally, Dr. Melanie Maas-Brunner offered analysts and investors an BASF was again recognized as a Global Compact LEAD company ▪ Capital Markets Day in March 2021, Investor Update in insight into the BASF Group’s research and development in Decem- by the U.N. Global Compact in 2021. BASF consistently supports September 2021 and R&D Webcast in December 2021 ber 2021. In a webcast, she presented, among other topics, contri- the U.N. Global Compact and its 10 principles of responsible busi- butions of research to sustainability in the field of electromobility. ness conduct and the Sustainable Development Goals. Our corporate strategy aims to create long-term value. We support this strategy through regular and transparent communication with Analysts and investors have confirmed the quality of our financial BASF was among the top 10% in the World Benchmarking Alliance’s the capital market. In light of the coronavirus pandemic, we almost market communications. For instance, we were again named “Best (WBA) Food and Agriculture Benchmark, which assessed 350 com- exclusively used virtual formats such as video or conference calls for IR” in the materials sector in the annual survey conducted by Britain’s panies from the food and agricultural sector on sustainable business dialog in 2021. We engage with institutional investors and rating IR Magazine. practices. agencies in numerous one-on-one meetings, as well as at road- For more information about BASF stock, see basf.com/share For more information on the key sustainability indexes, see basf.com/sustainabilityindexes shows and conferences worldwide, and give private investors an For more information on the 2022–2023 share buyback program, see basf.com/sharebuyback For more information on energy and climate protection, see page 126 onward insight into BASF at informational events. For more information on the Capital Markets Day 2021, see basf.com/CMD21 For more information on air and soil, see page 133 For more information on the Investor Update 2021, see basf.com/investor-update For more information on the procurement of certified palm oil and palm kernel oil, see page 112 In March 2021, Dr. Martin Brudermüller presented our path and our For more information on the R&D Webcast 2021, see basf.com/rd-webcast-2021 onward ambitious climate neutrality targets at a virtual Capital Markets Day. Register for the newsletter with current topics and dates at basf.com/share/newsletter BASF aims to achieve net zero CO emissions2 by 2050. Based on Contact the Investor Relations team by phone at +49 621 60-48230 or email [email protected] 2 Analysts’ recommendations its progress in developing low-emission and carbon-free technolo- gies, BASF is also setting an ambitious medium-term 2030 target Around 30 financial analysts regularly publish studies on BASF. The for reductions in greenhouse gas emissions: BASF now wants to latest analyst recommendations for our shares as well as the reduce its greenhouse gas emissions worldwide by 25% compared average target share price ascribed to BASF by analysts can be with 2018 – and to achieve this despite targeted growth and the found online at basf.com/analystestimates. construction of a large Verbund site in Zhanjiang, China. Dr. Markus Kamieth and Saori Dubourg also presented the Industrial Solutions and Nutrition & Care segments in more detail during the virtual Capital Markets Day. 1 Sustainalytics provides institutional investors and companies with ESG and corporate governance research, ratings and analytics. 2 Based on the BASF Group’s Scope 1 and Scope 2 emissions; other greenhouse gases are converted into CO equivalents in accordance with the Greenhouse Gas Protocol 2

BASF Report 2021 16 Contents Management’s To Our Shareholders Management’s Report Corporate Governance Consolidated Financial Statements Report Overviews 2 Overview 17 The BASF Group’s Business Year 52 Sustainability Along the Value Chain 96 Nonfinancial Statement Disclosures 18 Economic Environment 52 We Value People and Treat Them with Respect 97 TCFD Recommendations Index 19 Results of Operations 56 Responsible Procurement 109 Net Assets 61 Safe and Efficient Production 117 The BASF Group 20 Financial Position 63 Sustainable Solutions 141 How We Create Value 24 Actual Development Compared With Outlook for 2021 67 Forecast 145 Our Strategy 26 Business Review by Segment 69 Economic Environment in 2022 145 Chemicals 72 Our Strategic Action Areas 28 Outlook 2022 148 Materials 76 Our Values and Global Standards 31 Opportunities and Risks 151 Industrial Solutions 79 Business Models of the Segments 33 Surface Technologies 82 Targets and Target Achievement 2021 36 Nutrition & Care 85 Material Investments and Portfolio Measures 38 ricultural Solutions Ag 88 Our Steering Concept 42 Other 92 Our Sustainability Concept 45 Non-Integral Oil and Gas Business 93 Innovation 49 Regional Results 94 E.U. Taxonomy 95

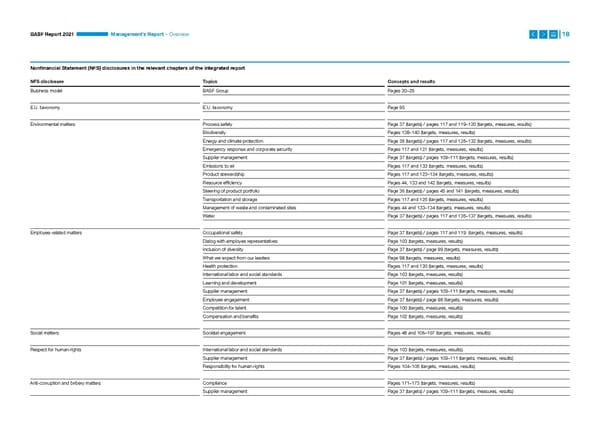

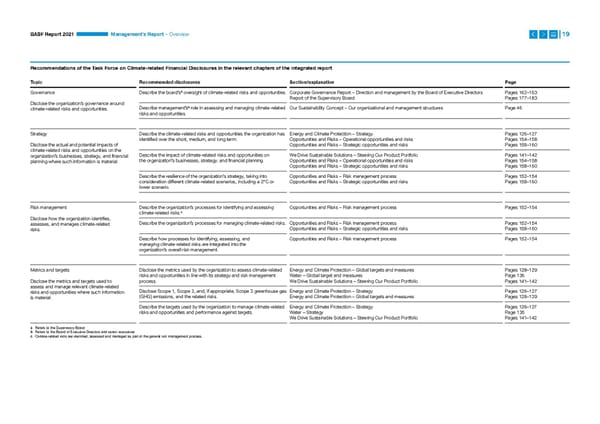

BASF Report 2021 Management’s Report – Overview 17 Overview share of the Group’s taxonomy-eligible sales, investments (including Directors and the Supervisory Board (excluding the disclosures acquisitions) and operating expenses for the 2021 business year required by takeover law in accordance with section 315a HGB), relating to the environmental objectives of “climate change miti- compliance reporting and the Declaration of Conformity pursuant to The Management’s Report comprises the chapter of the gation” and “adaptation to climate change.” section 161 of the German Stock Corporation Act. Pur suant to same name on pages 16 to 160, as well as the disclosures section 317(2) sentence 6 HGB, the auditor checked that the disclo- required by takeover law and the Declaration of Corporate Within the scope of the annual audit, KPMG checked pursuant to sures according to section 315d HGB were made. Governance, which are presented in the Corporate Gover- section 317(2) sentence 4 HGB that the NFS was presented in nance chapter. The Nonfinancial Statement (NFS) is integrated accordance with the statutory requirements. KPMG also conducted into the Management’s Report. a limited assurance of the NFS. An assurance statement of the Compensation Report limited assurance can be found online at basf.com/nfs-audit-2021. The assurance was conducted in accordance with ISAE 3000 The Compensation Report is no longer a component of the Nonfinancial Statement (NFS) in accordance with (Assurance Engagements other than Audits or Reviews of Historical Management’s Report. The Compensation Report in accordance sections 315b and 315c of the German Commercial Code Financial Information) and ISAE 3410 (Assurance Engagements on with section 162 of the German Stock Corporation Act (AktG) and (HGB) Greenhouse Gas Statements), the relevant international assurance the assurance statement of the substantive and formal audit issued standards for sustainability reporting. by the auditor have been made publicly available on the BASF The NFS disclosures can be found in the relevant sections of the website at basf.com/compensationreport. Management’s Report and have been prepared in accordance with the appropriate frameworks: the Global Reporting Initiative Stan- Disclosures required by takeover law in accordance with dards (“Comprehensive” application option) and the reporting section 315a HGB Content and structure of the Management’s Report requirements of the U.N. Global Compact. The disclosures required by takeover law in accordance with sec- An overview of the segments’ business models is provided in a The table on the following page shows the sections and subsections tion 315a of the German Commercial Code (HGB) can be found in separate chapter. Material investments and portfolio measures by in which the individual disclosures can be found. In addition to a the Corporate Governance chapter starting on page 161. They form our segments have also been integrated into the chapter of the description of the business model, the NFS includes disclosures on part of the Management’s Report, which is audited as part of the same name. This improves the clarity of the information on our the following matters, to the extent that they are required to under- annual audit. segments. stand the development and performance of the business, the Group’s position and the impact of business development on the following matters: Consolidated Declaration of Corporate Governance in Recommendations of the Task Force on Climate-related accordance with section 315d HGB in connection with Financial Disclosures – Environmental matters section 289f HGB – Employee-related matters BASF supports the recommendations of the Task Force on Climate- – Social matters The Consolidated Declaration of Corporate Governance in accor- related Financial Disclosures (TCFD). Disclosures recommended by – Respect for human rights dance with section 315d HGB in connection with section 289f HGB the TCFD are presented in a number of places throughout this – Anti-corruption and bribery matters can be found in the Corporate Governance chapter from page 185 report. The table on page 19 shows the sections and subsections in onward and is a component of the Management’s Report. It com- which the relevant information can be found. The table is divided In accordance with the E.U. Taxonomy Regulation and the supple- prises the Corporate Governance Report including the description into four key areas in line with the TCFD recommendations: gover- mentary delegated acts, the NFS includes, for the first time, the of the diversity concept for the composition of the Board of Exe cu tive nance, strategy, risk management, and metrics and targets.

BASF Report 2021 Management’s Report – Overview 18 Nonfinancial Statement (NFS) disclosures in the relevant chapters of the integrated report NFS disclosure Topics Concepts and results Business model BASF Group Pages 20–25 E.U. taxonomy E.U. taxonomy Page 95 Environmental matters Process safety Page 37 (targets) / pages 117 and 119–120 (targets, measures, results) Biodiversity Pages 138–140 (targets, measures, results) Energy and climate protection Page 36 (targets) / pages 117 and 126–132 (targets, measures, results) Emergency response and corporate security Pages 117 and 121 (targets, measures, results) Supplier management Page 37 (targets) / pages 109–111 (targets, measures, results) Emissions to air Pages 117 and 133 (targets, measures, results) Product stewardship Pages 117 and 123–124 (targets, measures, results) Resource efficiency Pages 44, 133 and 142 (targets, measures, results) Steering of product portfolio Page 36 (targets) / pages 45 and 141 (targets, measures, results) Transportation and storage Pages 117 and 125 (targets, measures, results) Management of waste and contaminated sites Pages 44 and 133–134 (targets, measures, results) Water Page 37 (targets) / pages 117 and 135–137 (targets, measures, results) Employee-related matters Occupational safety Page 37 (targets) / pages 117 and 119 (targets, measures, results) Dialog with employee representatives Page 103 (targets, measures, results) Inclusion of diversity Page 37 (targets) / page 99 (targets, measures, results) What we expect from our leaders Page 98 (targets, measures, results) Health protection Pages 117 and 120 (targets, measures, results) International labor and social standards Page 103 (targets, measures, results) Learning and development Page 101 (targets, measures, results) Supplier management Page 37 (targets) / pages 109–111 (targets, measures, results) Employee engagement Page 37 (targets) / page 98 (targets, measures, results) Competition for talent Page 100 (targets, measures, results) Compensation and benefits Page 102 (targets, measures, results) Social matters Societal engagement Pages 48 and 106–107 (targets, measures, results) Respect for human rights International labor and social standards Page 103 (targets, measures, results) Supplier management Page 37 (targets) / pages 109–111 (targets, measures, results) Responsibility for human rights Pages 104–105 (targets, measures, results) Anti-corruption and bribery matters Compliance Pages 171–173 (targets, measures, results) Supplier management Page 37 (targets) / pages 109–111 (targets, measures, results)

BASF Report 2021 Management’s Report – Overview 19 Recommendations of the Task Force on Climate-related Financial Disclosures in the relevant chapters of the integrated report Topic Recommended disclosures Section/explanation Page Governance Describe the board’sa oversight of climate-related risks and opportunities. Corporate Governance Report – Direction and management by the Board of Executive Directors Pages 162–163 Report of the Supervisory Board Pages 177–183 Disclose the organization’s governance around climate-related risks and opportunities. Describe management’sb role in assessing and managing climate-related Our Sustainability Concept – Our organizational and management structures Page 46 risks and opportunities. Strategy Describe the climate-related risks and opportunities the organization has Energy and Climate Protection – Strategy Pages 126–127 identified over the short, medium, and long term. Opportunities and Risks – Operational opportunities and risks Pages 154–158 Disclose the actual and potential impacts of Opportunities and Risks – Strategic opportunities and risks Pages 158–160 climate-related risks and opportunities on the organization’s businesses, strategy, and financial Describe the impact of climate-related risks and opportunities on We Drive Sustainable Solutions – Steering Our Product Portfolio Pages 141–142 planning where such information is material. the organization’s businesses, strategy, and financial planning. Opportunities and Risks – Operational opportunities and risks Pages 154–158 Opportunities and Risks – Strategic opportunities and risks Pages 158–160 Describe the resilience of the organization’s strategy, taking into Opportunities and Risks – Risk management process Pages 152–154 consideration different climate-related scenarios, including a 2°C or Opportunities and Risks – Strategic opportunities and risks Pages 158–160 lower scenario. Risk management Describe the organization’s processes for identifying and assessing Opportunities and Risks – Risk management process Pages 152–154 climate- related risks.c Disclose how the organization identifies, assesses, and manages climate-related Describe the organization’s processes for managing climate-related risks. Opportunities and Risks – Risk management process Pages 152–154 risks. Opportunities and Risks – Strategic opportunities and risks Pages 158–160 Describe how processes for identifying, assessing, and Opportunities and Risks – Risk management process Pages 152–154 managing climate-related risks are integrated into the organization’s overall risk management. Metrics and targets Disclose the metrics used by the organization to assess climate-related Energy and Climate Protection – Global targets and measures Pages 128–129 risks and opportunities in line with its strategy and risk management Water – Global target and measures Page 136 Disclose the metrics and targets used to process. We Drive Sustainable Solutions – Steering Our Product Portfolio Pages 141–142 assess and manage relevant climate-related risks and opportunities where such information Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas Energy and Climate Protection – Strategy Pages 126–127 is material. (GHG) emissions, and the related risks. Energy and Climate Protection – Global targets and measures Pages 128–129 Describe the targets used by the organization to manage climate-related Energy and Climate Protection – Strategy Pages 126–127 risks and opportunities and performance against targets. Water – Strategy Page 135 We Drive Sustainable Solutions – Steering Our Product Portfolio Pages 141–142 a Refers to the Supervisory Board b Refers to the Board of Executive Directors and senior executives c Climate-related risks are identified, assessed and managed as part of the general risk management process.

BASF Report 2021 Management’s Report – BASF Group 20 BASF Group GRI 102, 201, 202, 203, 301 At BASF, we create chemistry for a sustainable future. We combine economic success with environmental protection and social r esponsibility. Around 111,000 employees contribute to the success of our customers in nearly all sectors and almost every country in the world. Our portfolio is divided into the Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care and Agricultural Solutions segments. Sites and Verbund The BASF Group’s segments in 2021 BASF has companies in 90 countries. We operate six V erbund sites and 232 additional production sites worldwide. Our Verbund site in Ludwigshafen, Germany, is the world’s largest integrated chemical complex owned by a single company. The Verbund concept was developed and optimized here and later applied to other sites around the world. Construction of the first plants continued at our planned new smart Verbund site in Chemicals Materials Industrial Solutions Zhanjiang, China. The Chemicals segment consists of the Petrochemi- The Materials segment is composed of the Perfor- The Industrial Solutions segment consists of the cals and Intermediates divisions. The segment mance Materials and Monomers divisions. The seg- Dispersions & Resins and the Performance Chemi- supplies BASF’s other segments and third-party ment offers advanced materials and their precursors cals divisions. The segment develops and markets The Verbund system is one of BASF’s great strengths. We add value cus tomers with basic chemicals and intermediates. for the plastics and plastics processing industries. ingredients and additives for industrial applications. by using our resources efficiently. The Production Verbund intelli- ▪ Share of sales: 17% ▪ Share of sales: 19% ▪ Share of sales: 11% gently links production units and their energy supply so that, for ▪ R&D expenses: €97 million ▪ R&D expenses: €193 million ▪ R&D expenses: €175 million 1 1 1 example, the waste heat of one plant provides energy to others. ▪ Investments including acquisitions : €1,157 million ▪ Investments including acquisitions : €709 million ▪ Investments including acquisitions : €361 million Furthermore, one facility’s by-products can serve as feedstocks elsewhere. This not only saves us raw materials and energy – it also avoids emissions, lowers logistics costs and leverages synergies. We also make use of the Verbund principle for more than produc- tion, applying it for technologies, the market and digitalization as well. Expert knowledge is pooled in our global research. For more information on the Verbund concept, see basf.com/en/verbund Surface Technologies Nutrition & Care Agricultural Solutions The Surface Technologies segment comprises the The Nutrition & Care segment comprises the Care The Agricultural Solutions segment is an integrated Catalysts and Coatings divisions. The segment Chemicals division and the Nutrition & Health provider of seeds, crop protection and digital offers chemical solutions for surfaces such as division. The segment produces ingredients and technologies and solutions. battery materi als and automotive coatings. solutions for consumer applications such as nutrition and personal care. ▪ Share of sales: 29% ▪ Share of sales: 8% ▪ Share of sales: 11% ▪ R&D expenses: €296 million ▪ R&D expenses: €172 million ▪ R&D expenses: €904 million 1 1 1 ▪ Investments including acquisitions : €1,469 million ▪ Investments including acquisitions : €654 million ▪ Investments including acquisitions : €347 million 1 Additions to property, plant and equipment and intangible assets

BASF Report 2021 Management’s Report – BASF Group 21 Organization of the BASF Group unit will continue to be globally positioned with research centers in Europe, North America and Asia Pacific. We take a differentiated approach to steering our businesses according to market-specific requirements and the competitive Five service units provide competitive services for the operating divi- environment. We provide a high level of transparency around the sions and sites: Global Engineering Services, Global Digital Services, results of our segments and show the importance of the Verbund Global Procurement, European Site & Verbund Management, Global and value chains to our business success. BASF aims to differen- Business Services (finance, human resources, environmental pro- tiate its businesses from their competitors and establish a high- tection, health and safety, intellectual property, communications, performance organization to enable BASF to be successful in an procurement, supply chain and inhouse consulting services). increasingly competitive market environment. Following the bundling of services and resources and the imple- The operating divisions, the service units, the regions and the corpo- mentation of a wide-ranging digitalization strategy, the number of rate center form the cornerstones of the BASF organization, in line employees in the Global Business Services unit worldwide will with the corporate strategy. As part of the implementation of our decline by up to 2,000 by the end of 2022 compared with base- strategy, we streamlined our administration, sharpened the roles line 2019. From 2023 onward, the division expects to achieve of services and regions, and simplified procedures and processes. annual cost savings of over €200 million. The organizational realignment created the conditions for greater customer proximity, increased competitiveness and profitable The Corporate Center supports the Board of Executive Directors in growth. steering the company as a whole. These include central tasks from the following areas: strategy, finance and controlling, compliance The divisions bear strategic and operational responsibility here and and law, tax, environmental protection, health and safety, human are organized according to sectors or products. They manage the resources, communications, investor relations and internal audit. 50 global and regional business units and develop strategies for 75 strategic business units. Our Excellence Program aimed to contribute €2 billion to EBITDA annually until the end of 2021 onward compared with baseline 2018. The regional and country units represent BASF locally and support We met this target in 2021. As planned, this was partly due to the the growth of business units with local proximity to customers. For reduction of more than 6,000 positions worldwide until the end of financial reporting purposes, we organize the regional divisions into 2021. This decrease resulted from the organizational simplification four regions: Europe, North America, Asia Pacific, and South America, and from efficiency gains in administration, the service units and the Africa and Middle East. operating divisions. For more information on the products and services offered by the segments, see pages 72, 76, 79, 82, Our research is currently divided into three global divisions: Process 85 and 88 onward Research & Chemical Engineering, Advanced Materials & Systems For more information on the segment structure, see Note 5 to the Consolidated Financial Statements from page 213 onward Research and Bioscience Research. To strengthen our innovation capabilities, we will reorganize our global research activities in 2022 and align them even more closely with the needs of our customers. To this end, we will integrate downstream research into the divisions and bundle activities with broad relevance in a research unit. This

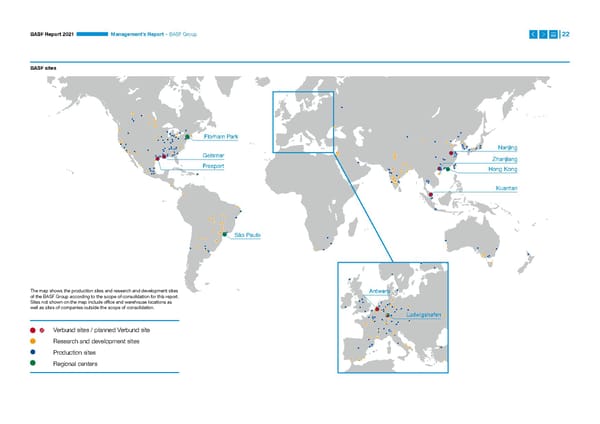

BASF Report 2021 Management’s Report – BASF Group 22 BASF sites Florham Park Nanjing Geismar Zhanjiang Freeport Hong Kong Kuantan São Paulo The map shows the production sites and research and development sites Antwerp of the BASF Group according to the scope of consolidation for this report. Sites not shown on the map include office and warehouse locations as well as sites of companies outside the scope of consolidation. Ludwigshafen Verbund sites / planned Verbund site Research and development sites Production sites Regional centers

BASF Report 2021 Management’s Report – BASF Group 23 BASF sales by region 2021 BASF sales by industry 2021 Corporate legal structure Location of customer Direct customers 7% As the publicly listed parent company of the BASF Group, BASF SE South America, Africa, > 20% Chemicals and plastics | Transportation (respectively) takes a central position: Directly or indirectly, it holds the shares in Middle East 39% 10%–20% Agriculture | Consumer goods (respectively) the companies belonging to the BASF Group, and is also one of Europe Construction | Electronics | Energy and resources | Health and the largest operating companies. The majority of Group companies €78,598 million < 10% nutrition (respectively) 27% cover a broad spectrum of our business. In the BASF Group Con- Asia Pacific solidated Financial Statements, 258 companies including BASF SE 27% are fully consolidated. We consolidate nine joint operations on a North America Business and competitive environment proportional basis and account for 27 companies using the equity method. BASF’s global presence means that it operates in the context For more information, see Note 2 to the Consolidated Financial Statements from page 205 onward Procurement and sales markets of local, regional and global developments and a wide range of conditions. These include: 1 BASF supplies products and services to around 90,000 customers – Global economic environment from various sectors in almost every country in the world. Our cus- – Legal and political requirements (such as European Union regula- tomer portfolio ranges from major global customers and small and tions) medium-sized enterprises to end consumers. – International trade agreements – Industry standards 2 We work with over 70,000 Tier 1 suppliers worldwide. They supply – Environmental agreements (such as the E.U. Emissions Trading us with important raw materials, chemicals, investment goods and System) consumables, and perform a range of services. Important raw – Social aspects (such as the U.N. Universal Declaration of Human materials (based on volume) include naphtha, liquid gas, natural Rights) gas, benzene and caustic soda. For more information on customers, see page 28 onward; for more information on suppliers, see BASF holds one of the top three market positions in around 80% page 109 onward of the business areas in which it is active. Our most important global competitors include Arkema, Bayer, Clariant, Corteva, Covestro, Dow, Dupont, DSM, Evonik, Huntsman, Lanxess, SABIC, Sinopec, Solvay, Sumitomo Chemical, Syngenta, Wanhua and many hundreds of local and regional competitors. We expect com- petitors from Asia and the Middle East in particular to continue to grow in significance in the years ahead. 1 The number of customers refers to all external companies (sold-to parties) that had contracts with the BASF Group in the business year concerned under which sales were generated. 2 BASF considers all direct suppliers of the BASF Group in the business year concerned as Tier 1 suppliers. These are suppliers that provide us with raw materials, investment goods, consumables and services. Suppliers can be natural persons, companies or legal persons under public law.

BASF Report 2021 Management’s Report – How We Create Value 24 How We Create Value 1 3 Inputs Outputs 2 Business The following overview provides examples of how we create value for our stakeholders. model It is modeled on the framework of the International Integrated Reporting Council (IIRC). 5 4 The content of the graphic has been audited within the scope of the relevant sections of Discover the interactive How We Create Value graphic in the Impact Outcomes the Management’s Report in which they appear. BASF Online Report at basf.com/how-we-create-value Inputs 1 Financial Innovation Operations Environment Employees Partnerships Our aim is to ensure solvency, We develop innovative Safety, quality, and reliability We use natural resources to Everything we do is based Trust-based relationships We use a wide range of limit financial risks and optimize solutions for and with our are key to excellence in our manufacture products and on the expertise, knowledge, are crucial to our license to resources to implement our the cost of capital. customers to expand our production and plant operations. solutions with high value added motivation and conduct of operate and our reputation. customer-focused strategy leading position. for our customers. our employees. €87.4 billion ~10,000 €3.4 billion 1.3 million metric tons 111,047 ~280 Total assets R&D employees Capex Renewable raw materials Employees around the world Research collaborations 3 48.2% €2.2 billion ~60 million MWh 1,695 million m €11.1 billion >70,000 Equity ratio R&D expenses Electricity and steam demand Total water usage Personnel expenses Suppliers Business model 2 Corporate purpose Our targets How we operate We create chemistry ▪ Profitable growth ▪ Our customers are at the core of our strategy. We implement our for a sustainable future ▪ Effective climate protection ▪ Sustainability and innovation is at the center of everything we do and a driver for growth and value. corporate purpose ▪ Product portfolio geared to innovation and sustainability ▪ Safety is always our number one priority. ▪ Responsible procurement ▪ BASF’s Verbund structure is the backbone of our efficient and reliable production. ▪ Resource-efficient and safe production ▪ Our six segments are aligned with value chains and address customer needs with differentiated solutions ▪ Employee engagement and diversity and business strategies. ▪ We have a global, customer-focused presence. ▪ Effective corporate governance ensures responsible conduct. ▪ We value our stakeholders and treat them with respect.

Outputs 3 Financial Innovation Operations Environment Employees Partnerships We focus on material €78.6 billion ~820 ~45,000 47.0% 25.6% 787 sustainability topics and Sales New patents worldwide Sales products Share of our waste recycled or Women in leadership positions Suppliers screened through evaluate the opportunities and thermally recovered Together for Sustainability risks of our actions €7.8 billion €24.1 billion 7.3 million metric tons 78.5% 82% 77 EBIT before special items Accelerator sales CO avoided by the Verbund Water demand Engagement index according to Internal audits on our 2 and combined heat and power generation recirculated 2020 employee survey compliance standards 1 Outcomes 4 Economic Environmental Social We aim to increase our positive contributions, minimize negative We make positive contributions by We make positive contributions by creating products that We make positive contributions because we impacts and carefully assess ▪ Driving forward growth, progress and value creation ▪ Contribute to climate protection ▪ Offer products that improve people’s quality of life conflicting goals ▪ Strengthening our customers’ competitiveness and innovative ▪ Conserve resources, avoid waste and strengthen circularity ▪ Provide attractive jobs and promote diversity strength ▪ Pave the way for climate-friendly mobility ▪ Pay taxes and competitive wages and salaries ▪ Accelerating the digital transformation of the industry ▪ Are environmentally friendly and safe to use ▪ Promote integration and help overcome social challenges ▪ Offering our investors an attractive dividend yield Potential negative impacts Negative impacts Potential negative impacts ▪ Weaker growth stimulus due to the coronavirus pandemic, the ▪ The emission of CO and other gases that affect the climate ▪ Risk of violation of labor, environmental and social standards 2 ongoing trade conflict between the United States and China, ▪ Resource consumption and non-recyclable waste in the production of the raw materials we procure and an escalation of geopolitical conflicts ▪ Potential misuse or spillage of products ▪ Lower demand for employees in some areas ▪ A weaker share performance Our countermeasures Our countermeasures Our countermeasures ▪ Disciplined implementation of our corporate strategy ▪ Carbon management ▪ Careful selection, evaluation and development of suppliers ▪ Active portfolio management ▪ Circular Economy Program ▪ Projects to improve sustainability in the supply chains ▪ Systematic cost management ▪ Sustainable water and energy management ▪ Compliance Program and Code of Conduct ▪ Optimizing the cost of capital ▪ Responsible Care management (including product stewardship) ▪ Employee training program Impact We achieve long-term business success by creating value for our shareholders, our company, 5 the environment and society (see page 47 and basf.com/en/value-to-society) 1 The outcomes category shows examples of positive contributions as well as negative impacts and the measures we take to mitigate them.

Our Strategy BASF Report 2021 Management’s Report – Our Strategy 26 Our Strategy In this section: Strategic Action Areas GRI 102 Values and Global Standards Chemistry is our passion. As an industry leader, we want to be the most attractive partner for challenges that can be solved Business Models of the Segments with chemistry. That is why our customers are at the center of everything we do. We want to grow profitably and at the same Targets and Target Achievement 2021 time, create value for society and the environment. We help to change the world for the better with our expertise, our innovative Investments and Portfolio Measures and entrepreneurial spirit, and the power of our Verbund integration. This is our goal, embedded in our corporate purpose: Steering Concept We create chemistry for a sustainable future. Sustainability Concept Innovation The world is changing at a rapid pace – more and more urgently We also see these disruptive changes as an opportunity. As the Good to know than ever, solutions are needed for a more sustainable future. world’s largest chemical company, we want to lead the way and Chemistry plays a key role here. In almost all areas of life, it can help actively and responsibly shape the change. That is why we are overcome pressing global challenges with innovative products gradually switching our energy and raw material supplies to renew- and technologies – from climate change and using resources more able sources. We are strengthening our Verbund structure as the sparingly to feeding the world’s population. This belief is expressed basis for resource-efficient, safe and reliable production. We are in our corporate purpose and is what motivates us day in and day developing pioneering low-carbon production processes for our out: We create chemistry for a sustainable future. products. We are accelerating our innovation processes and deep- ening cooperation with partners to develop high-performance Our corporate purpose products that also require fewer resources and have a lower carbon footprint. We are harnessing the many opportunities of digitalization. We create chemistry for a sustainable future We are systematically aligning our portfolio with growth areas and Net Zero Accelerator future technologies, and are integrating sustainability into our value chains even more strongly. We create a working environment in The new Net Zero Accelerator unit started work on January 1, Our mission and motivation is to grow profitably and make a positive which our employees can thrive and contribute to BASF’s long-term 2022. It bundles the extensive cross-company activities with contribution to society and the environment. For example, BASF’s success. This is how we live our corporate purpose. which we want to achieve our ambitious climate protection solutions contribute to climate protection and help to prevent or For more information on our strategic action areas, see page 28 onward targets. The unit will initially have around 80 employees and recycle waste, produce healthy and affordable food, and enable report directly to the Chairman of the Board of Executive climate-smart mobility. Directors. It will focus on accelerating and implementing projects relating to low-CO production technologies, circular 2 At the same time, as an energy and resource-intensive company, we economy and renewable energies – driving forward BASF’s are facing what is probably the biggest transformation in our over transformation to a climate-neutral company. In parallel, our 150-year history: The shift toward a carbon-neutral and circular operating divisions will continue to work on divisional-specific economy and the associated landmarks such as the European carbon reduction projects. Green Deal demand from us new concepts and approaches – for the For more information on climate neutrality, see pages 27 and 126 to 132 way we produce, for our raw material base and for our energy supply.

In Focus: Climate Neutrality BASF Report 2021 Management’s Report – In Focus: Climate Neutrality 27 In focus: Our Journey to Climate Neutrality Climate change is the greatest challenge of the 21st century. Swift and resolute action is needed to ensure that the targets agreed in the Paris Climate Agreement can be achieved. We stand by this responsibility. In many areas, products and innovations based on chemistry are the key to a climate- neutral future. At the same time, we are working intensively to significantly reduce the carbon footprint of our production and thus of our products. Our target: net zero emissions by 2050. We have set ourselves an One thing is clear: The transformation will require significantly more ambitious milestone on this path. By 2030, we want to reduce the energy from renewable sources. Initial estimates suggest that at the greenhouse gas emissions from our production sites and our energy Ludwigshafen site in Germany alone, we would need to roughly purchases by 25% compared with 2018 – while growing production triple or quadruple our current electricity use (2021: 6.0 TWh) to volumes. This corresponds to a decrease of around 60% compared fully implement new, low-carbon electricity-based production pro- with 1990. We are intensely pursuing our climate protection targets cesses. To meet this demand, we are investing in our own power with investments of up to €4 billion by 2030. Our focus here is on assets, especially for wind power, and are increasingly buying green five strategic levers: We are increasingly meeting our energy electricity on the market (make & buy approach). needs from renewable sources (gray-to-green lever). We are increasingly relying on energy recovery to produce steam (power- Also critical to success are prices for renewable energy. Substi- to-steam lever). We are working to further improve the energy and tuting fossil fuels is only economically feasible at production costs of process efficiency of our plants (continuous opex lever). We are 4 to 5 cents/kWh. Consequently, there is an urgent need to expand increasingly replacing fossil resources with bio-based raw materials supply and reduce the levies and fees on electricity prices. In addi- (bio-based feedstocks lever). And together with partners, we are tion, globally comparable carbon pricing – or at least at G20 level – is pioneering nearly carbon-free production processes, especially for needed to ensure that climate-friendly processes are competitive emission- intensive basic chemicals (new technologies lever). internationally. For more information on energy and climate protection, see page 126 onward We want to play an active and responsible role in shaping the For more information on raw materials, see page 112 onward transition toward a climate-neutral society. This calls for new ways of thinking and working together. And it needs a political and regu- Our global climate protection targets latory environment that promotes innovation in climate protection, makes it possible to develop new, climate-smart processes that are –25% Net zero competitive internationally and, above all, resolutely drives forward Renewable energy is a central building block on BASF’s journey to the expansion of renewable energies – including through the appro- Reduction in our greenhouse gas Greenhouse gas emissions by climate neutrality. To enable us to meet our growing demand in the priate land use designations, rapid planning and approval proce- emissions by 2030 compared 2050 (Scope 1 and 2) future, we are gradually switching our supply agreements to green dures and the swift expansion of grid infrastructure. with 2018 (Scope 1 and 2) power and investing in our own plants. Find out more about how we are driving forward the transformation of our energy supply in the online report at report.basf.com.

BASF Report 2021 Management’s Report – Our Strategic Action Areas 28 Our Strategic Action Areas Our customers are our number one priority and are at the heart innovation and growth potential together with them. For instance, Good to know of our strategy. We want to be their most attractive partner for chal- we established interdisciplinary teams in our business units to even lenges that can be solved with chemistry. BASF supplies products better and more quickly address the needs of our most important and services to around 90,000 customers1 from almost all sectors customers. and countries around the world. Our customer portfolio ranges from major global customers and small and medium-sized enterprises to BASF’s strategic orientation is founded on a comprehensive end consumers. Our comprehensive product portfolio means that analysis of our markets and competitors. We continuously monitor we are active in many value chains and value creation networks. We global trends and anticipate the resulting growth opportunities and use various business strategies, which we adapt to the needs of risks. The following six strategic focus areas enable us to focus on individual industries and markets. These range from cost leadership our customers while strengthening our leading position in an increas- in basic chemicals to tailored system solutions for specific customer ingly volatile and competitive environment. applications. Innovation Selected awards Innovation is the bedrock of our success. BASF is a leader in the chemical industry with around 10,000 employ ees in research and The virtual car ▪ Ford: World Excellence Award development and R&D spending of around €2.2 billion. We are ▪ Dulux: Supplier of the Year Award The automotive industry is one of our most important customer expand ing this position by strengthening specific research activities, sectors. In February 2021, we launched an interactive platform ▪ 3M: Supplier of the Year Award for example in battery materials, polymer technologies, catalyst that showcases BASF’s wide range of solutions and innovation processes or biotechnological methods. In addition, we are bringing expertise in mobility: Customers can explore over 500 application We continue to drive forward our customer focus. We have refined research and development even closer together, incorporating our areas in a new virtual car – from high-performance plastics and our organizational structure to enable our operating divisions to customers’ requirements into our innovation processes even earlier coatings to automotive fluids, catalysts, cathode materials and flexibly address specific market requirements and differentiate them- and more intensively, and expanding cooperation with customers, more. Detailed information is provided on all products and solu- selves from the competition. universities, research institutions and other partners. To further tions. The virtual car offers a selection of different powertrain strengthen our innovation power, we will reorganize our global technologies: combustion engine, plug-in hybrid, battery electric We are also improving our customer relationships with a range of research activities in 2022 and bundle them in a global research unit vehicle and fuel cell vehicle. E-mobility solutions can also be filtered measures. For example, since 2019 we have been using the Net based in Ludwigshafen, Germany. by material properties such as battery efficiency, corrosion protec- Promoter System® worldwide to systematically record and optimize tion or thermal protection. our problem-solving skills, product quality and delivery reliability Our innovation pipeline is geared to sustainability – especially Discover the virtual car at basf-vcar.com based on direct customer feedback. We have been using a new climate protection and the circular economy. This lays the founda- IT-based customer relationship management system, Salesforce, tion for future growth: We are working intensively on fundamental since 2020. The application helps our sales employees to provide innovations for products, processes and business models, for customer support and simplifies their work. Above and beyond this, example in the chemical recycling of plastics, battery and catalyst we have intensified cooperation with our customers to leverage technologies, low-carbon production of basic chemicals, and digital, 1 The number of customers refers to all external companies (sold-to parties) that had contracts with the BASF Group in the business year concerned under which sales were generated.