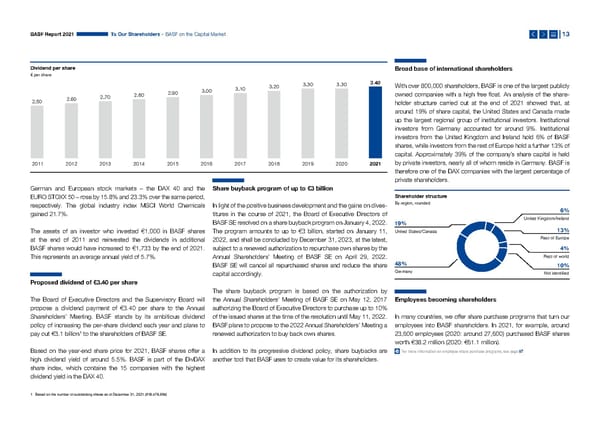

BASF Report 2021 To Our Shareholders – BASF on the Capital Market 13 Dividend per share Broad base of international shareholders € per share 3.20 3.30 3.30 3.40 With over 800,000 shareholders, BASF is one of the largest publicly 2.90 3.00 3.10 2.70 2.80 owned companies with a high free float. An analysis of the share- 2.50 2.60 holder structure carried out at the end of 2021 showed that, at around 19% of share capital, the United States and Canada made up the largest regional group of institutional investors. Institutional investors from Germany accounted for around 9%. Institutional investors from the United Kingdom and Ireland hold 6% of BASF shares, while investors from the rest of Europe hold a further 13% of capital. Approximately 39% of the company’s share capital is held 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 by private investors, nearly all of whom reside in Germany. BASF is therefore one of the DAX companies with the largest percentage of private shareholders. German and European stock markets – the DAX 40 and the Share buyback program of up to €3 billion EURO STOXX 50 – rose by 15.8% and 23.3% over the same period, Shareholder structure respectively. The global industry index MSCI World Chemicals In light of the positive business development and the gains on dives- By region, rounded gained 21.7%. titures in the course of 2021, the Board of Executive Directors of 6% BASF SE resolved on a share buyback program on January 4, 2022. United Kingdom/Ireland 19% The assets of an investor who invested €1,000 in BASF shares The program amounts to up to €3 billion, started on January 11, United States/Canada 13% at the end of 2011 and reinvested the dividends in additional 2022, and shall be concluded by December 31, 2023, at the latest, Rest of Europe BASF shares would have increased to €1,733 by the end of 2021. subject to a renewed authorization to repurchase own shares by the 4% This represents an average annual yield of 5.7%. Annual Shareholders’ Meeting of BASF SE on April 29, 2022. Rest of world BASF SE will cancel all repurchased shares and reduce the share 48% 10% capital accordingly. Germany Not identified Proposed dividend of €3.40 per share The share buyback program is based on the authorization by The Board of Executive Directors and the Supervisory Board will the Annual Shareholders’ Meeting of BASF SE on May 12, 2017 Employees becoming shareholders propose a dividend payment of €3.40 per share to the Annual authorizing the Board of Executive Directors to purchase up to 10% Shareholders’ Meeting. BASF stands by its ambitious dividend of the issued shares at the time of the resolution until May 11, 2022. In many countries, we offer share purchase programs that turn our policy of increasing the per-share dividend each year and plans to BASF plans to propose to the 2022 Annual Shareholders’ Meeting a employees into BASF shareholders. In 2021, for example, around pay out €3.1 billion1 to the shareholders of BASF SE. renewed authorization to buy back own shares. 23,600 employees (2020: around 27,600) purchased BASF shares worth €38.2 million (2020: €61.1 million). Based on the year-end share price for 2021, BASF shares offer a In addition to its progressive dividend policy, share buybacks are For more information on employee share purchase programs, see page 97 high dividend yield of around 5.5%. BASF is part of the DivDAX another tool that BASF uses to create value for its shareholders. share index, which contains the 15 companies with the highest dividend yield in the DAX 40. 1 Based on the number of outstanding shares as of December 31, 2021 (918,478,694)

Integrated Report | BASF Page 12 Page 14

Integrated Report | BASF Page 12 Page 14