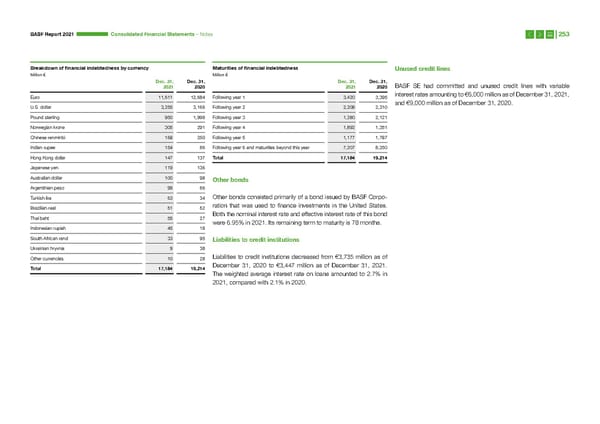

BASF Report 2021 Consoli dated Financial Statements – Notes 253 Breakdown of financial indebtedness by currency Maturities of financial indebtedness Unused credit lines Million € Million € Dec. 31, Dec. 31, Dec. 31, Dec. 31, BASF SE had committed and unused credit lines with variable 2021 2020 2021 2020 Euro 11,611 12,684 Following year 1 3,420 3,395 interest rates amounting to €6,000 million as of December 31, 2021, and €9,000 million as of December 31, 2020. U.S. dollar 3,255 3,166 Following year 2 2,208 2,310 Pound sterling 950 1,998 Following year 3 1,280 2,121 Norwegian krone 305 291 Following year 4 1,892 1,351 Chinese renminbi 168 250 Following year 5 1,177 1,787 Indian rupee 154 86 Following year 6 and maturities beyond this year 7,207 8,250 Hong Kong dollar 147 137 Total 17,184 19,214 Japanese yen 119 136 Australian dollar 100 98 Other bonds Argentinian peso 99 66 Turkish lira 63 34 Other bonds consisted primarily of a bond issued by BASF Corpo- Brazilian real 61 62 ration that was used to finance investments in the United States. Thai baht 55 27 Both the nominal interest rate and effective interest rate of this bond were 6.95% in 2021. Its remaining term to maturity is 78 months. Indonesian rupiah 45 18 South African rand 33 95 Liabilities to credit institutions Ukrainian hryvnia 9 38 Other currencies 10 28 Liabilities to credit institutions decreased from €3,735 million as of Total 17,184 19,214 December 31, 2020 to €3,447 million as of December 31, 2021. The weighted average interest rate on loans amounted to 2.7% in 2021, compared with 2.1% in 2020.

Integrated Report | BASF Page 252 Page 254

Integrated Report | BASF Page 252 Page 254