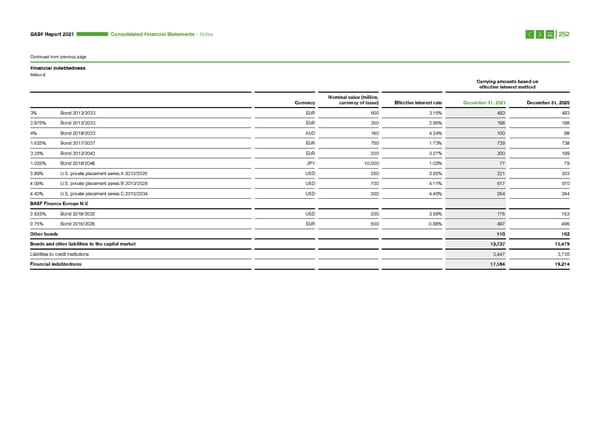

BASF Report 2021 Consoli dated Financial Statements – Notes 252 Continued from previous page Financial indebtedness Million € Carrying amounts based on effective interest method Nominal value (million, Currency currency of issue) Effective interest rate December 31, 2021 December 31, 2020 3% Bond 2013/2033 EUR 500 3.15% 493 493 2.875% Bond 2013/2033 EUR 200 2.96% 198 198 4% Bond 2018/2033 AUD 160 4.24% 100 98 1.625% Bond 2017/2037 EUR 750 1.73% 739 738 3.25% Bond 2013/2043 EUR 200 3.27% 200 199 1.025% Bond 2018/2048 JPY 10,000 1.03% 77 79 3.89% U.S. private placement series A 2013/2025 USD 250 3.92% 221 203 4.09% U.S. private placement series B 2013/2028 USD 700 4.11% 617 570 4.43% U.S. private placement series C 2013/2034 USD 300 4.45% 264 244 BASF Finance Europe N.V. 3.625% Bond 2018/2025 USD 200 3.69% 176 163 0.75% Bond 2016/2026 EUR 500 0.88% 497 496 Other bonds 110 102 Bonds and other liabilities to the capital market 13,737 15,479 Liabilities to credit institutions 3,447 3,735 Financial indebtedness 17,184 19,214

Integrated Report | BASF Page 251 Page 253

Integrated Report | BASF Page 251 Page 253