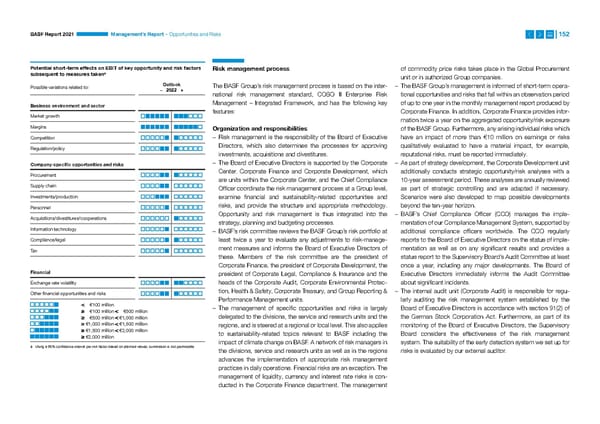

BASF Report 2021 Management’s Report – Opportunities and Risks 152 Potential short-term effects on EBIT of key opportunity and risk factors Risk management process of commodity price risks takes place in the Global Procurement a subsequent to measures taken unit or in authorized Group companies. Possible variations related to: Outlook The BASF Group’s risk management process is based on the inter- – The BASF Group’s management is informed of short-term opera- – 2022 + national risk management standard, COSO II Enterprise Risk tional opportunities and risks that fall within an observation period Business environment and sector Management – Integrated Framework, and has the following key of up to one year in the monthly management report produced by features: Corporate Finance. In addition, Corporate Finance provides infor- Market growth mation twice a year on the aggregated opportunity/risk exposure Margins Organization and responsibilities of the BASF Group. Furthermore, any arising individual risks which Competition – Risk management is the responsibility of the Board of Executive have an impact of more than €10 million on earnings or risks Regulation/policy Directors, which also determines the processes for approving qualitatively evaluated to have a material impact, for example, investments, acquisitions and divestitures. reputational risks, must be reported immediately. Company-specific opportunities and risks – The Board of Executive Directors is supported by the Corporate – As part of strategy development, the Corporate Development unit Procurement Center. Corporate Finance and Corporate Development, which additionally conducts strategic opportunity/risk analyses with a are units within the Corporate Center, and the Chief Compliance 10-year assessment period. These analyses are annually reviewed Supply chain Officer coordinate the risk management process at a Group level, as part of strategic controlling and are adapted if necessary. Investments/production examine financial and sustainability-related opportunities and Scenarios were also developed to map possible developments Personnel risks, and provide the structure and appropriate methodology. beyond the ten-year horizon. Opportunity and risk management is thus integrated into the – BASF’s Chief Compliance Officer (CCO) manages the imple- Acquisitions/divestitures/cooperations strategy, planning and budgeting processes. mentation of our Compliance Management System, supported by Information technology – BASF’s risk committee reviews the BASF Group’s risk portfolio at additional compliance officers worldwide. The CCO regularly Compliance/legal least twice a year to evaluate any adjustments to risk-manage- reports to the Board of Executive Directors on the status of imple- Tax ment measures and informs the Board of Executive Directors of mentation as well as on any significant results and provides a these. Members of the risk committee are the president of status report to the Supervisory Board’s Audit Committee at least Corporate Finance, the president of Corporate Development, the once a year, including any major developments. The Board of Financial president of Corporate Legal, Compliance & Insurance and the Executive Directors immediately informs the Audit Committee Exchange rate volatility heads of the Corporate Audit, Corporate Environmental Protec- about significant incidents. Other financial opportunities and risks tion, Health & Safety, Corporate Treasury, and Group Reporting & – The internal audit unit (Corporate Audit) is responsible for regu- Performance Management units. larly auditing the risk management system established by the €100 million – The management of specific opportunities and risks is largely Board of Executive Directors in accordance with section 91(2) of €100 million €500 million €500 million €1,000 million delegated to the divisions, the service and research units and the the German Stock Corporation Act. Furthermore, as part of its €1,000 million €1,500 million regions, and is steered at a regional or local level. This also applies monitoring of the Board of Executive Directors, the Supervisory €1,500 million €2,000 million to sustainability-related topics relevant to BASF including the Board considers the effectiveness of the risk management €2,000 million impact of climate change on BASF. A network of risk managers in system. The suitability of the early detection system we set up for a Using a 95% confidence interval per risk factor based on planned values; summation is not permissible the divisions, service and research units as well as in the regions risks is evaluated by our external auditor. advances the implementation of appropriate risk management practices in daily operations. Financial risks are an exception. The management of liquidity, currency and interest rate risks is con- ducted in the Corporate Finance department. The management

Integrated Report | BASF Page 151 Page 153

Integrated Report | BASF Page 151 Page 153