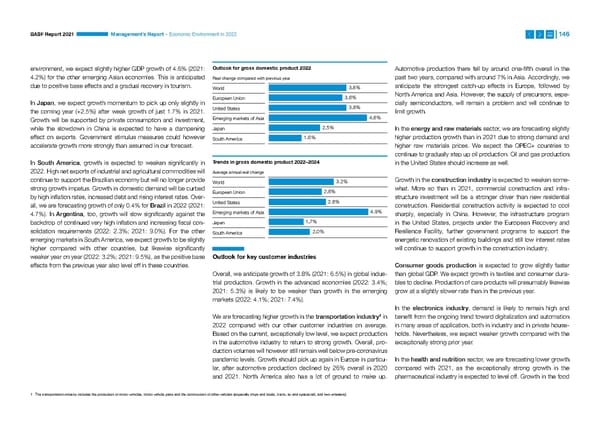

BASF Report 2021 Management’s Report – Economic Environment in 2022 146 environ ment, we expect slightly higher GDP growth of 4.6% (2021: Outlook for gross domestic product 2022 Auto motive production there fell by around one-fifth overall in the 4.2%) for the other emerging Asian economies. This is anticipated Real change compared with previous year past two years, compared with around 7% in Asia. Accordingly, we due to positive base effects and a gradual recovery in tourism. World 3.8% anticipate the strongest catch-up effects in Europe, followed by European Union 3.6% North America and Asia. However, the supply of precursors, espe- In Japan, we expect growth momentum to pick up only slightly in cially semiconductors, will remain a problem and will continue to the coming year (+2.5%) after weak growth of just 1.7% in 2021. United States 3.8% limit growth. Growth will be supported by private consumption and investment, Emerging markets of Asia 4.8% while the slowdown in China is expected to have a dampening Japan 2.5% In the energy and raw materials sector, we are forecasting slightly effect on exports. Government stimulus measures could however South America 1.6% higher production growth than in 2021 due to strong demand and accelerate growth more strongly than assumed in our forecast. higher raw materials prices. We expect the OPEC+ countries to continue to gradually step up oil production. Oil and gas production In South America, growth is expected to weaken significantly in Trends in gross domestic product 2022–2024 in the United States should increase as well. 2022. High net exports of industrial and agricultural commodities will Average annual real change continue to support the Brazilian economy but will no longer provide World 3.2% Growth in the construction industry is expected to weaken some- strong growth impetus. Growth in domestic demand will be curbed European Union 2.6% what. More so than in 2021, commercial construction and infra- by high inflation rates, increased debt and rising interest rates. Over- structure investment will be a stronger driver than new residential all, we are forecasting growth of only 0.4% for Brazil in 2022 (2021: United States 2.8% construction. Residential construction activity is expected to cool 4.7%). In Argentina, too, growth will slow significantly against the Emerging markets of Asia 4.9% sharply, especially in China. However, the infrastructure program backdrop of continued very high inflation and increasing fiscal con- Japan 1.7% in the United States, projects under the European Recovery and solidation requirements (2022: 2.3%; 2021: 9.0%). For the other South America 2.0% Resilience Facility, further government programs to support the emerging markets in South America, we expect growth to be slightly ener getic renovation of existing buildings and still low interest rates higher compared with other countries, but likewise significantly will continue to support growth in the construction industry. weaker year on year (2022: 3.2%; 2021: 9.5%), as the positive base Outlook for key customer industries effects from the previous year also level off in these countries. Consumer goods production is expected to grow slightly faster Overall, we anticipate growth of 3.8% (2021: 6.5%) in global indus- than global GDP. We expect growth in textiles and consumer dura- trial production. Growth in the advanced economies (2022: 3.4%; bles to decline. Production of care products will presumably likewise 2021: 5.3%) is likely to be weaker than growth in the emerging grow at a slightly slower rate than in the previous year. markets (2022: 4.1%; 2021: 7.4%). In the electronics industry, demand is likely to remain high and 1 We are forecasting higher growth in the transportation industry in benefit from the ongoing trend toward digitalization and automation 2022 compared with our other customer industries on average. in many areas of application, both in industry and in private house- Based on the current, exceptionally low level, we expect production holds. Nevertheless, we expect weaker growth compared with the in the automotive industry to return to strong growth. Overall, pro- exceptionally strong prior year. duction volumes will however still remain well below pre-coronavirus pandemic levels. Growth should pick up again in Europe in particu- In the health and nutrition sector, we are forecasting lower growth lar, after automotive production declined by 26% overall in 2020 compared with 2021, as the exceptionally strong growth in the and 2021. North America also has a lot of ground to make up. pharmaceutical industry is expected to level off. Growth in the food 1 The transportation industry includes the production of motor vehicles, motor vehicle parts and the construction of other vehicles (especially ships and boats, trains, air and spacecraft, and two-wheelers).

Integrated Report | BASF Page 145 Page 147

Integrated Report | BASF Page 145 Page 147